One World Shipbrokers’ MSI ticks up for the first time in a year

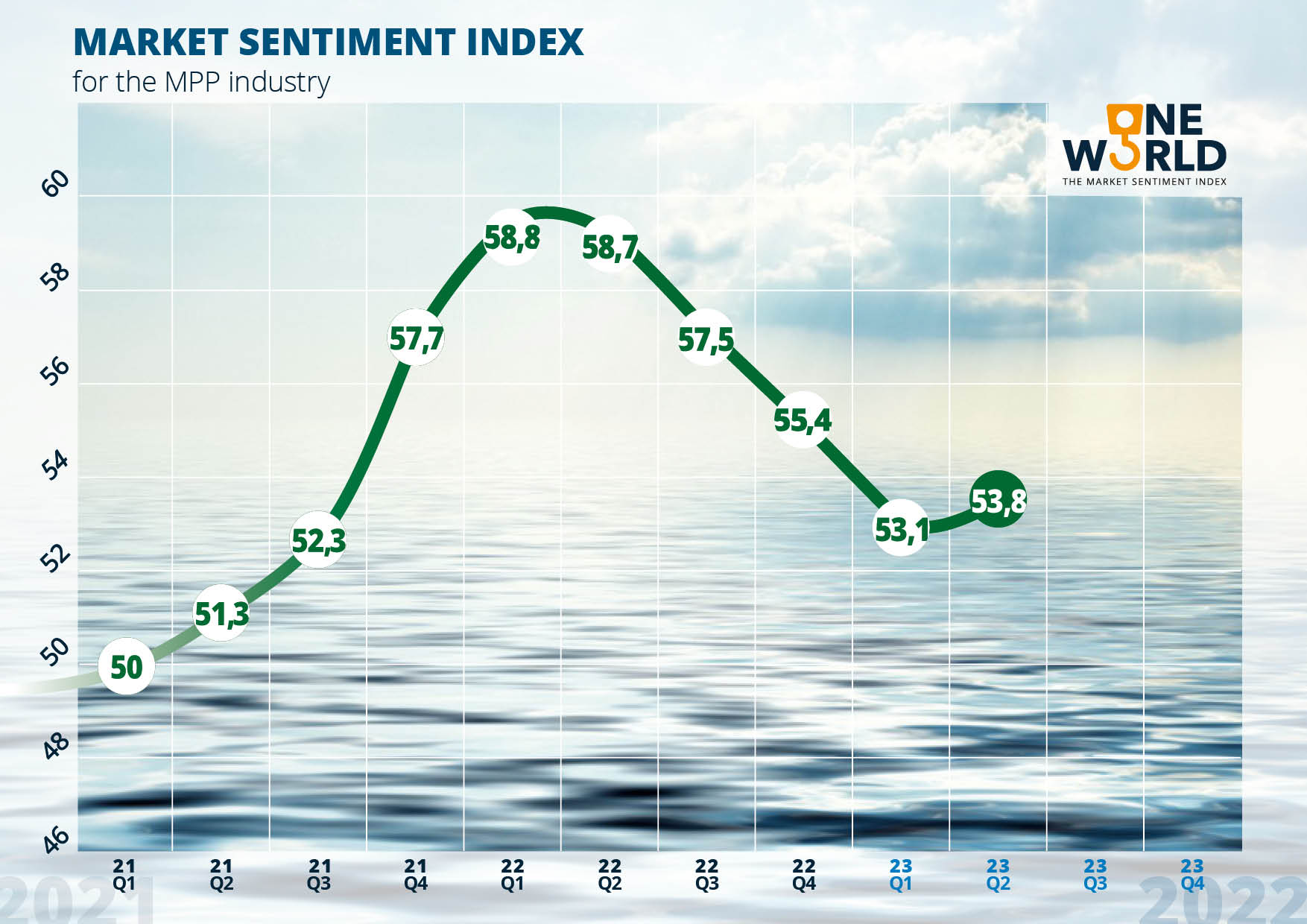

The Market Sentiment Index, an indicator of activity in the MPP industry, readied by the Hamburg-based specialised shipbroking house, One World Shipbrokers, has ticked up for the first time since the first quarter of 2022.

The MSI averages the responses from an anonymous group of multipurpose vessel owner and operators to a set of breakbulk shipping-related questions. A reading of 50 is neutral, indicating a static market; scores below 50 show pessimism or wariness, and a score above 50 indicates optimism.

The April MSI figure of 53.8 – up from 53.1 – snapping falls for each of the last 4 editions, is the first rise of the index in a year. Sentiment has improved for all inputs that comprise the index but this is tempered by ongoing caution in the shorter term and the upcoming summer period which is notoriously hard to predict, One World Shipbrikers’ assessment reads.

Getting closer to spot rates

“Whilst carriers believe recent falls in activity and freight rates have now stabilised, pressure remains high in general breakbulk where vessels are running closer to spot than at any time since late 2021,” One World Shipbrokers say.

Carriers are reporting that freight rates ex Asia are currently especially variable in response to what is described as confusing local signals which is reflected in lower short term confidence than in other markets.

Longer term the index is forecast to rise with expectations of a broad based recovery remaining intact.

Major projects in both renewables and oil & gas throughout the world are set to substantially increase MPP demand and tighten supply especially for the heavier lifting vessels. U.S. based carriers appear demonstrably more confident in the longer term than elsewhere underpinned by a slew of new projects slated to begin later this year.

Uncertainty over upcoming emission regulations

With no new newbuilding orders reported in the deep sea MPP segment this quarter or deliveries scheduled that will add any meaningful capacity to the world fleet, demolition activity is unsurprisingly low.

Yet with an average vessel age of over 15 years and the impact of new and upcoming emission regulations set to add surcharges to the less efficient older vessels carriers note there is uncertainty about the impact its introduction will bring – especially in Europe.

Fleet supply readings this quarter show a marginal tip towards shippers. But the outlook for later this year is that this will reverse towards carriers.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.