Drewry: multipurpose vessel charter rates continue downward trend

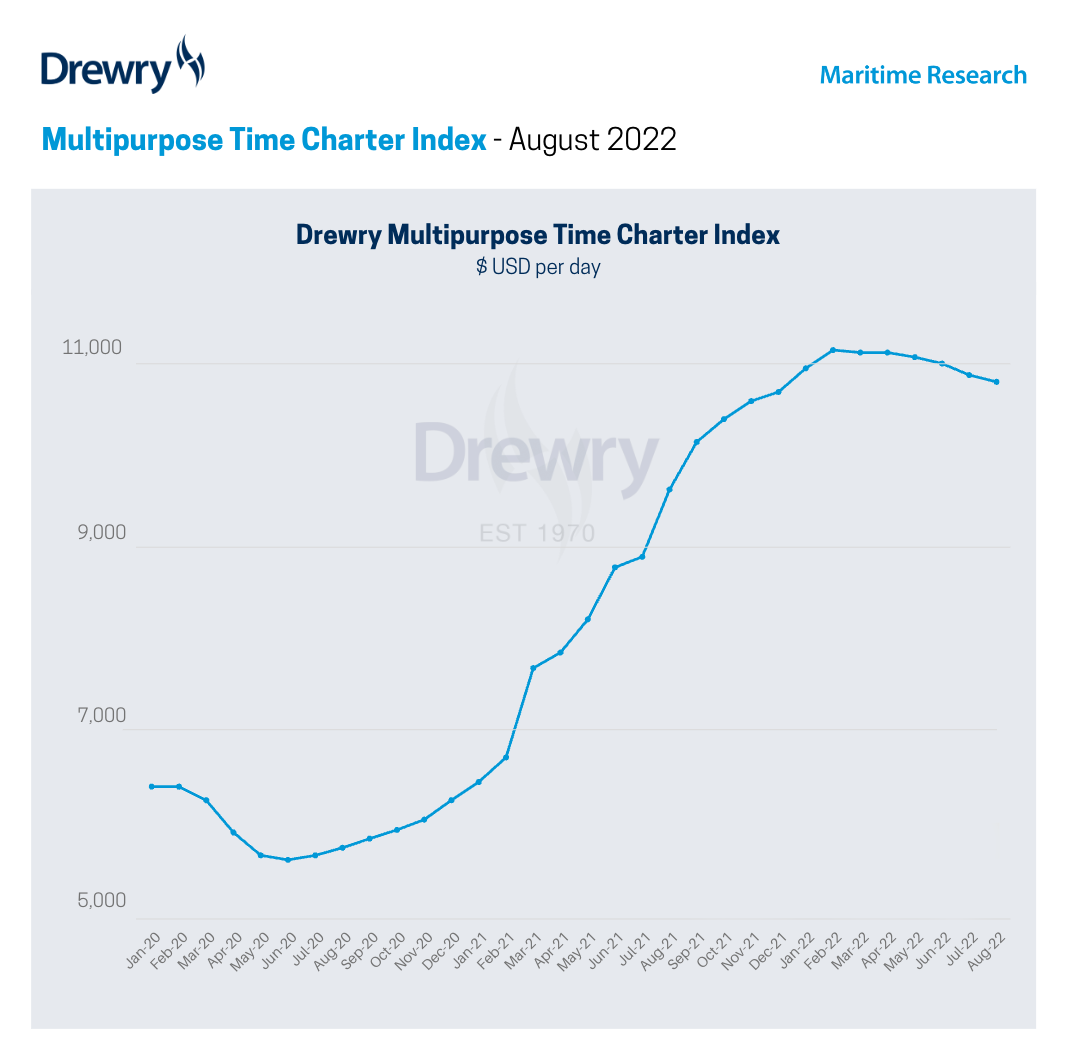

The downward trajectory of the Drewry Multipurpose Time Charter Index continued in July, and the weakening trend is not expected to stop any time soon.

Over the month of July, Drewry Multipurpose Time Charter Index declined by a further 1.1 percent from the June figures, to $11,925 per day as global uncertainty increased and operators remained hesitant to commit to long term charters at current high levels.

Going forward Drewry analysts expect the weakening trend to continue over the summer, with rates dropping a further 0.7 percent, to $10,850 per day during August.

“The increasing worries about inflation in Europe and the US coupled with China’s response to Nancy Pelosi’s visit to Taiwan, has meant that macro-economic uncertainty remains one of the bigger drivers for this sector. At the same time Handy spot rates and the smaller container vessels saw charter rates continue to fall over July, as activity levels fell as the European holiday season started,” Drewry said in its latest report.

For the smaller, mainly short-sea fleet, activity levels were more in line with a ‘normal summer market’ with noticeably fewer cargoes available over the month and more vessels open. For the larger vessels, with more heavy-lift capability, there remains a good level of optimism for renewables cargoes, but here too the spot market started to wane as time charter period lengths started to decrease.

Going forward Drewry expects this declining trend to continue through August as activity levels remain subdued, although rates might rise towards month end if the container market sees an early peak season restart in the run up to Christmas.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.