Drewry: multipurpose vessel rates heading back down

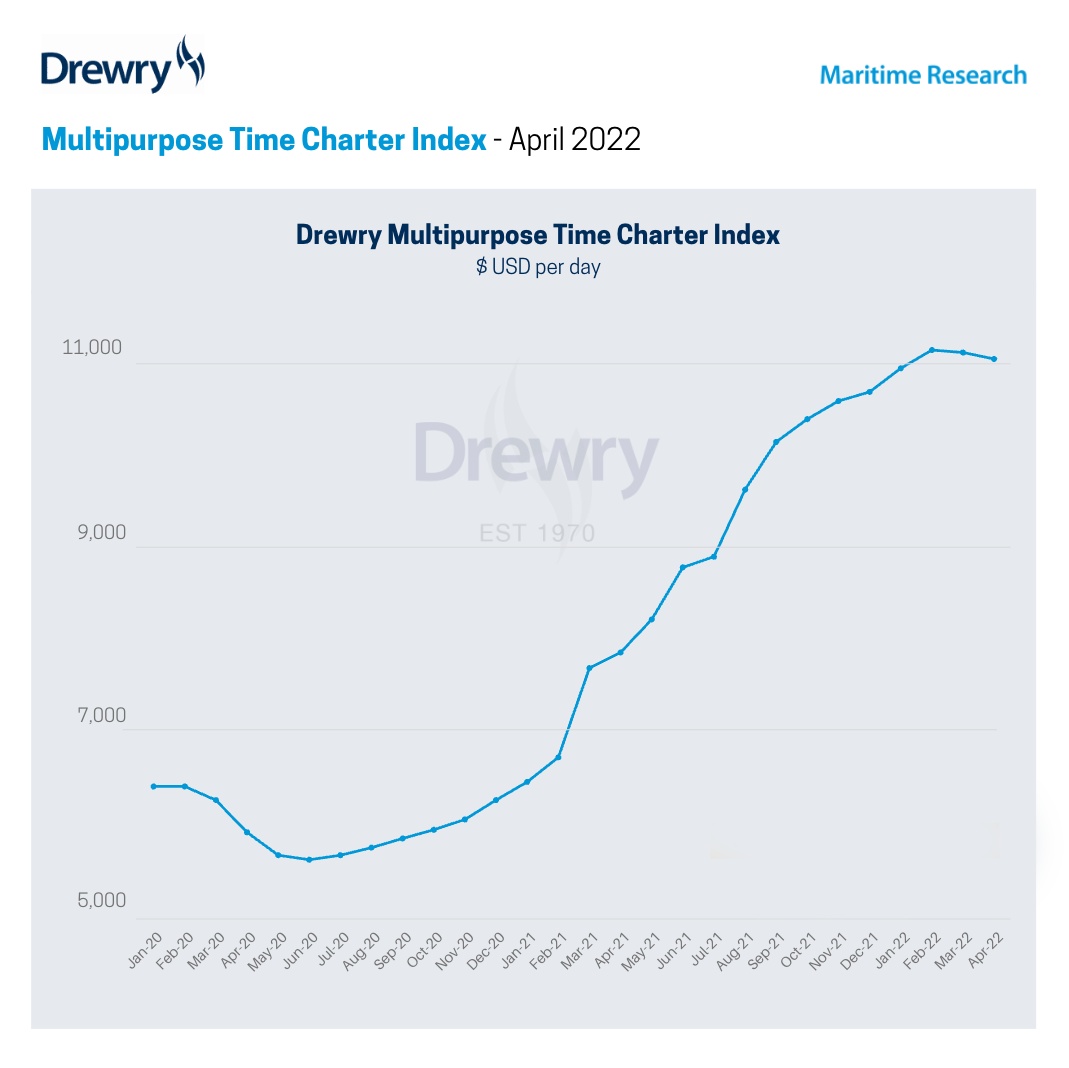

Daily rates rise for the multipurpose vessels have started petering out, with the shipping consultancy Drewry expecting the downward trend to continue further into April.

The Drewry Multipurpose Time Charter Index decreased slightly over March to $11,170 per day, representing a drop of just 0.2 percent compared to the 1.8 percent rise seen in the previous month. Russia’s invasion of Ukraine might not have a clear impact on MPV trades, except perhaps in the short-sea Northern European market, but the impact on global confidence, rising commodity prices and the competing sectors, has definitely caused the recent rate rise to falter. Drewry expect this weakening trend to continue into April with the Index dropping perhaps a further 0.5 percent to $11,100 per day.

The short-sea market saw rates plateau over March as the impact of the loss of trade in the Black Sea started to become clear. With the growing realisation that Ukrainian grain exports, a staple of the Spring market, will not be happening, the market could easily start to slide further. However bunker prices rising to exceptional levels will keep rates artificially elevated for the time being, hence Drewry’s expectation of rate stagnation.

For the more heavylift capable fleet, a wait-and-see attitude seems to be prevailing. While the Black Sea trades have less of an impact on the longer haul trades, the decline in optimism, growing oil price and increasing uncertainty leave little room for rate increases. Rates for the larger vessels saw some benefit from the latest port congestion in China and project carriers are still in demand to fill the supply breach. Drewry expects that as the conflict in Ukraine continues, weaker global confidence will balance out any potential demand improvement due to increased tonne miles.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.