New MPV tonnage unlikely to reach 2019 levels – Drewry

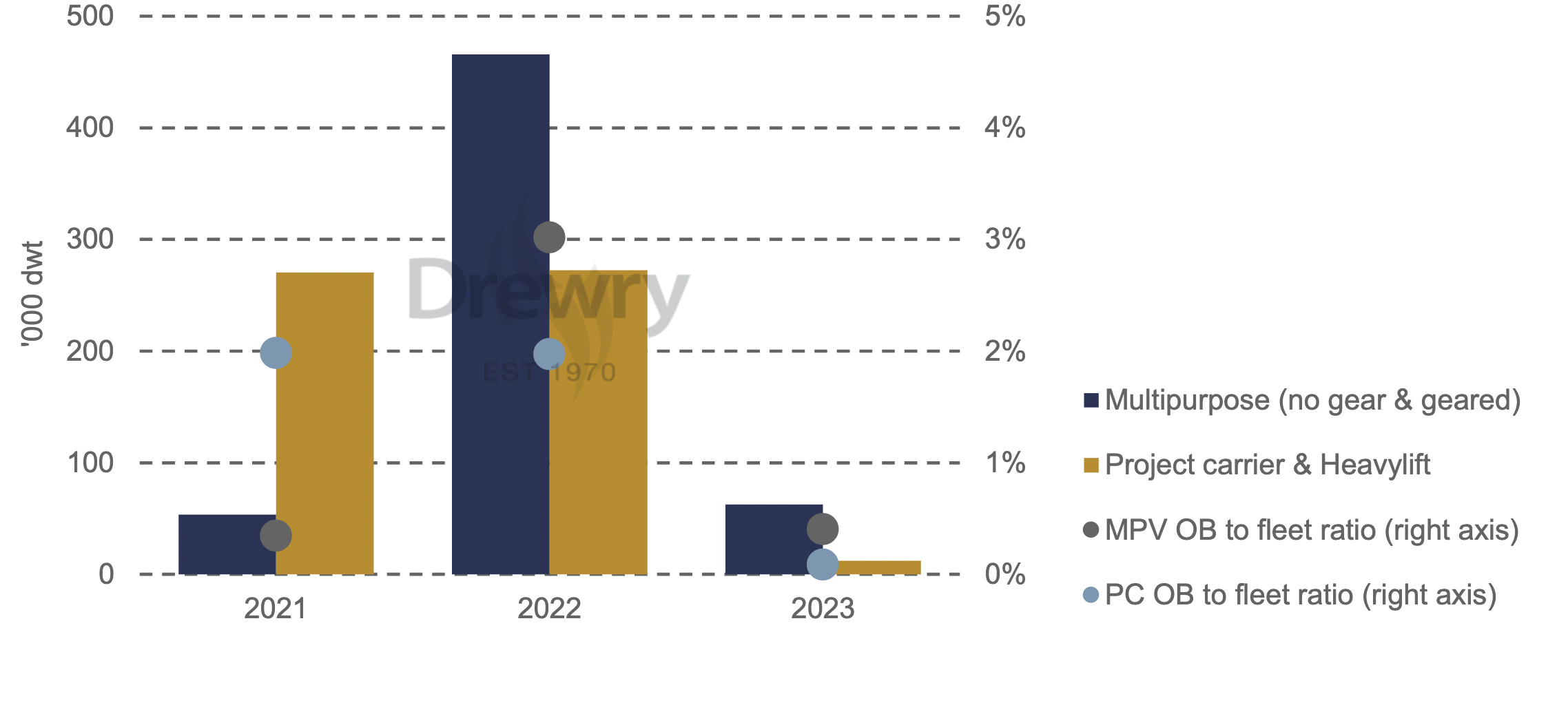

The orderbook for new multipurpose vessels, which include breakbulk and project cargo ships are again lagging behind the dry bulk and containership. The MPV newbuild orders are not expected to reach pre-Covid levels this year with only 160,000 dwt ordered during the year so far.

The MPV market, that has been in a recession for the past 10 years, is even struggling to reach 2019 figures at just 200,000 dwt. Drewry‘s senior analyst, multipurpose & breakbulk shipping, Susan Oatway additionally noted in a briefing that the tonnage ordered so far in 2021 has heavy-lift capacity below 100 tons. This means for the first time in a number of years, the percentage of heavy-lift capable tonnage on order is less than that of non heavy-lift capable tonnage.

This goes in hand with the fact that the MPV owners are notoriously cautious. This is a niche sector that is heavily influenced by the competing container and bulk sectors. It is also a sector for which there is little if any speculative market. Owners build to replace or do so with a particular commodity/project contract in mind.

The aforementioned recession has seen rates at or below operating costs in some cases. This means that even with a bull market seen in the past nine months, there is not much spare cash for new tonnage. “Added to this is the simple fact that the yards are full of orders for containership and bulk carriers, so even if owners had the spare cash and the desire to build, there are very few slots available”, Oatway said.

Speaking during a Drewry’s webinar, Oatway noted it is a surprise that there are so few orders, despite the industry being the way it is, with yards fully booked by other vessel types and the MPV owners being cautious. She added that the main concern now is the age of the fleet which, around 2023 when there will be even less newbuilding deliveries, the average age will be well over 16 years, and even the modern heavy-lift capable vessels will have an average age of over 15 years.

“Although these ships trade a long time, and over 20 years is common, and not an issue, but it will mean that we get a much tighter supply of modern tonnage if shippers need that for their projects,” Oatway says.

Drewry’s concern is that it has the potential to leave a short term hole in the project carrier sector at the point when project cargo could take off again. That said this shortage in supply around 2023 will coincide with the influx of the container carrier newbuildings, so may actually help to keep the supply side constrained.

MPV demolition grinds to a halt in Q3 2021

On the other side of the supply equation is demolition. Here too, activity levels are very weak and indeed practically ground to a halt over the third quarter of 2021, Oatway notes in the briefing. In a strong charter market this is less surprising, as currently every available vessel is on the ocean. Indeed, Drewry have reduced their expectations for this year and next, and believe the charter market will be a stronger pull than the demolition sector.

However, here too, 2023 could be a watershed year. At this point the average age of the fleet (multipurpose and project carrier combined) will be over 20 years. It is true that most of the overage tonnage is less than 10,000 dwt and not heavylift capable, but it still transports a significant volume of breakbulk cargo. At this point the latest IMO rulings on GHG emissions will become much more significant for this tonnage and demolition levels are expected to rise. Without newbuildings to replace them, Drewry expects a period of fleet decline in the medium term.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.