Multipurpose earnings rally at risk from overordering in competing sectors

The rapid recovery in earnings for multipurpose vessels is expected to slow from the second half of the year as capacity constraints and supply chain disruptions in competing sectors ease. Global shipping consultancy Drewry states this in its Multipurpose Shipping Annual Review & Forecast.

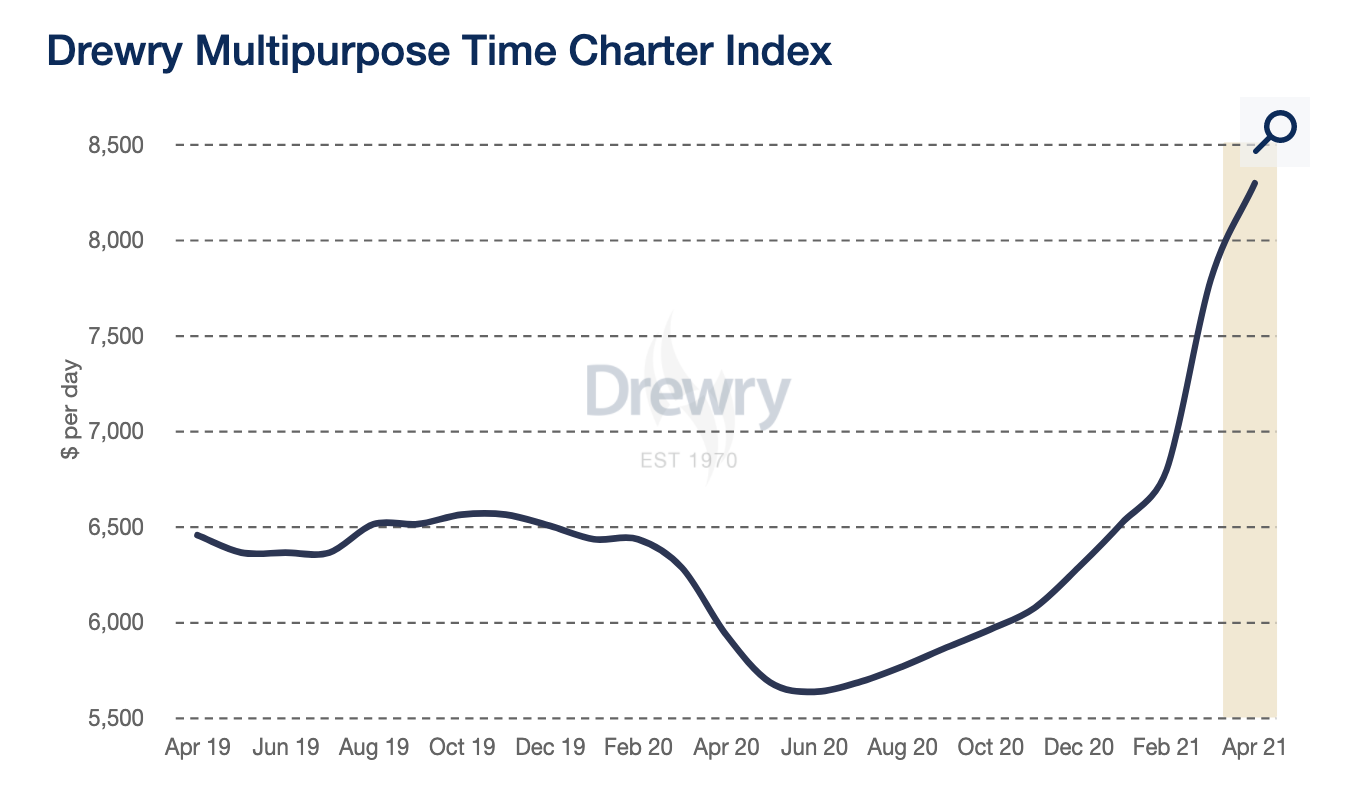

In March, one-year time charter rates for multipurpose (MPV) tonnage, incorporating both breakbulk and heavy lift ships, reached their highest level in almost six years, according to Drewry’s Multipurpose Time Charter Index (see below). However, despite this rally, earnings remain low by historical standards, off 40% from their all-time peak of 2007.

“The recent rally in multipurpose earnings represents a climb out of one of the longest recessions in recent history in this cyclical market”, says Drewry’s senior analyst for multipurpose & breakbulk shipping Susan Oatway. “And make no mistake, this recovery is fragile, as it is on the back of capacity issues in the competing sectors of dry bulk and container shipping, rather than any fundamental change in the multipurpose segment.”

Source: Drewry’s Multipurpose Forecaster

Newbuild tonnage poses threat

Drewry states that there is more room for optimism than twelve months ago. A statement which it bases largely on its forecast for effective cargo demand for the MPV fleet to rise at an average annual rate of around 5% from 2020 to 2025. However, there are still caveats to this outlook, according to the consultancy, given the continued levels of uncertainty around the global economic recovery, vaccine roll-out and trade development.

“One of the main reasons recovery is fragile for this sector is the level of overage tonnage in the fleet”, adds Oatway. “Over 50% of the total fleet is over 15 years old. Although the fleet contracted in 2020, due to increased demolition with no corresponding new building deliveries, our concern is that increased optimism will lead to new investment decisions, without corresponding cargo commitments.”

Dreary feels the booming dry bulk and container shipping markets may lead to equally rash newbuilds, which risk upturning any supply-demand balance currently in place. Although the possible market slowdown will take a couple of years to materialise, it is a real factor in the longer-term health of the MPV market.

Also read: Drewry expects MPV and heavy-lift growth to slow in second quarter

Growth will slow

It is true that the MPV charter market is benefiting from booming competing sector charter markets, as cargo owners seek to find capacity anywhere for their cargo. For this reason alone, Drewry expects rates to continue accelerating through 2Q21. However, as the capacity issues right themselves, this almost exponential growth rate will slow. Drewry forecasts that average annual one-year charter rates will climb 10% in 2021 and continue rising thereafter but at a much slower pace.

“Our optimism therefore remains cautious for the longer term, given that current high charter rates are relative to a prolonged market trough and could prove short-term due to the contributing factors. While lack of investment has been an ongoing issue in this sector for a number of years, any rush to build would risk delaying sustained recovery”, concludes Oatway.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.