Again less breakbulk for Port of Antwerp

Europe’s biggest breakbulk port, Antwerp, posted another decline in throughput of conventional breakbulk cargoes. The port contributes the decrease to the “exceptional” first quarter of 2018 when anticipated US import levies drove a build-up of steel stocks, but the throughput of conventional breakbulk declined in that quarter as well.

Despite falling 5% Port of Antwerp says breakbulk did “rather well in the first quarter of 2019, but moderately well compared to the exceptional first quarter of 2018, driven by the build-up of steel stocks in anticipation of US import levies.”

However, total conventional breakbulk throughput fell in the first quarter of 2018 as well. Even though steel performed well that quarter due to strong export growth to the United States, the port saw its total breakbulk volume decline by 3.1% due to trade volatility and containerisation of non-ferrous metals, wood, paper & cellulose and fruit, which posted the largest drop in that quarter.

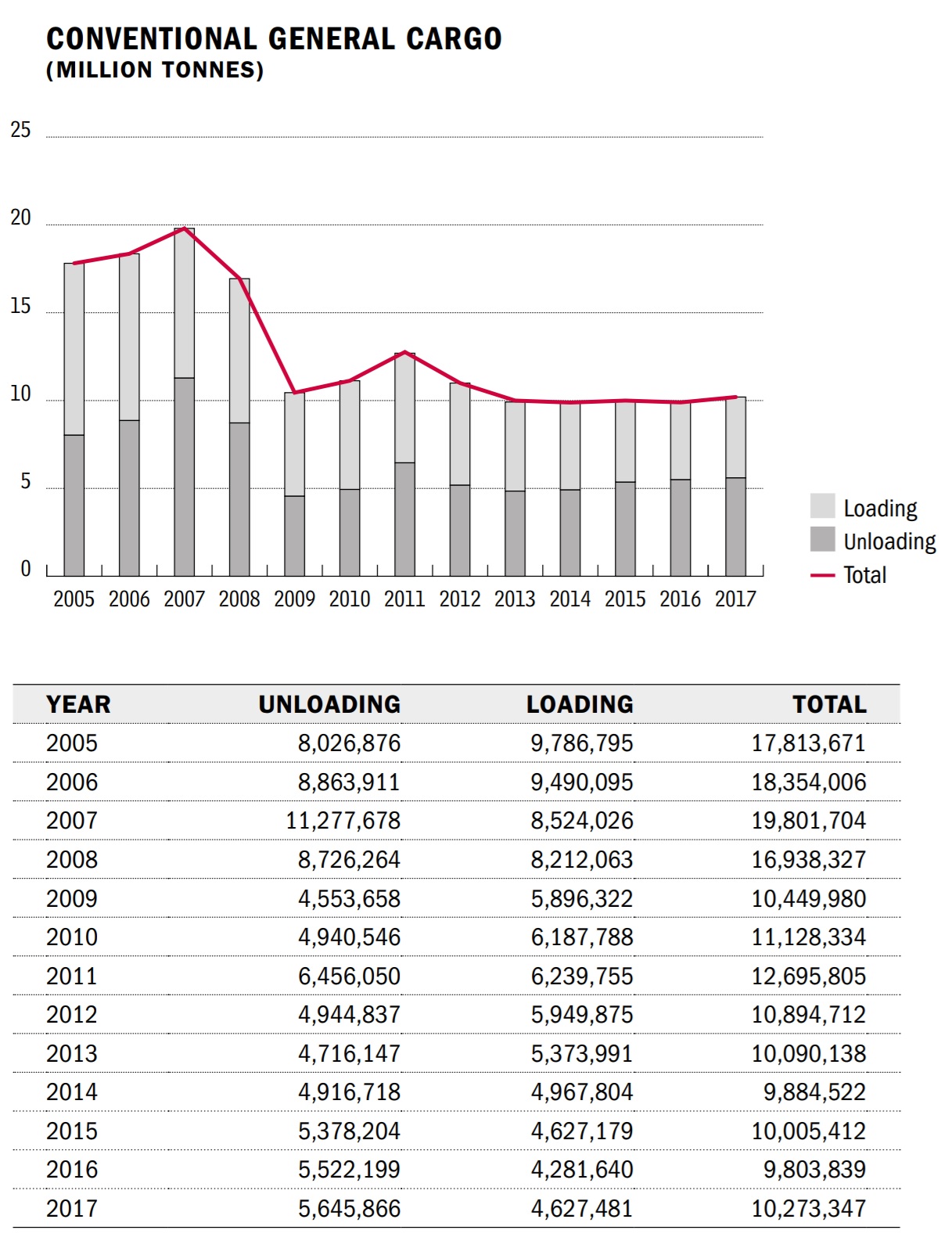

In general, containerisation has led to a worldwide decline in breakbulk volumes for the past decade and that trend is clearly visible in the historical data of Port of Antwerp. Since 2013, however, Antwerp’s breakbulk volume has hovered around the 10 million ton barrier and 2018 is no exception.

After the first nine months of 2018, conventional breakbulk volumes were set to fall by 2.7% but strong iron and steel volumes in the last quarter eased the decline and limited it to 1.1%, resulting in total transhipment of 10.16 million tonnes. With 2019 starting worse than last year, the question is if the same will happen this year.

Notable is that Rotterdam’s conventional breakbulk volume actually increased in the first quarter of 2019. The Dutch port recorded a growth of 3.1% to 1.5 million tonnes, thanks to increased volumes of non-ferrous metals, forest products and project cargo.

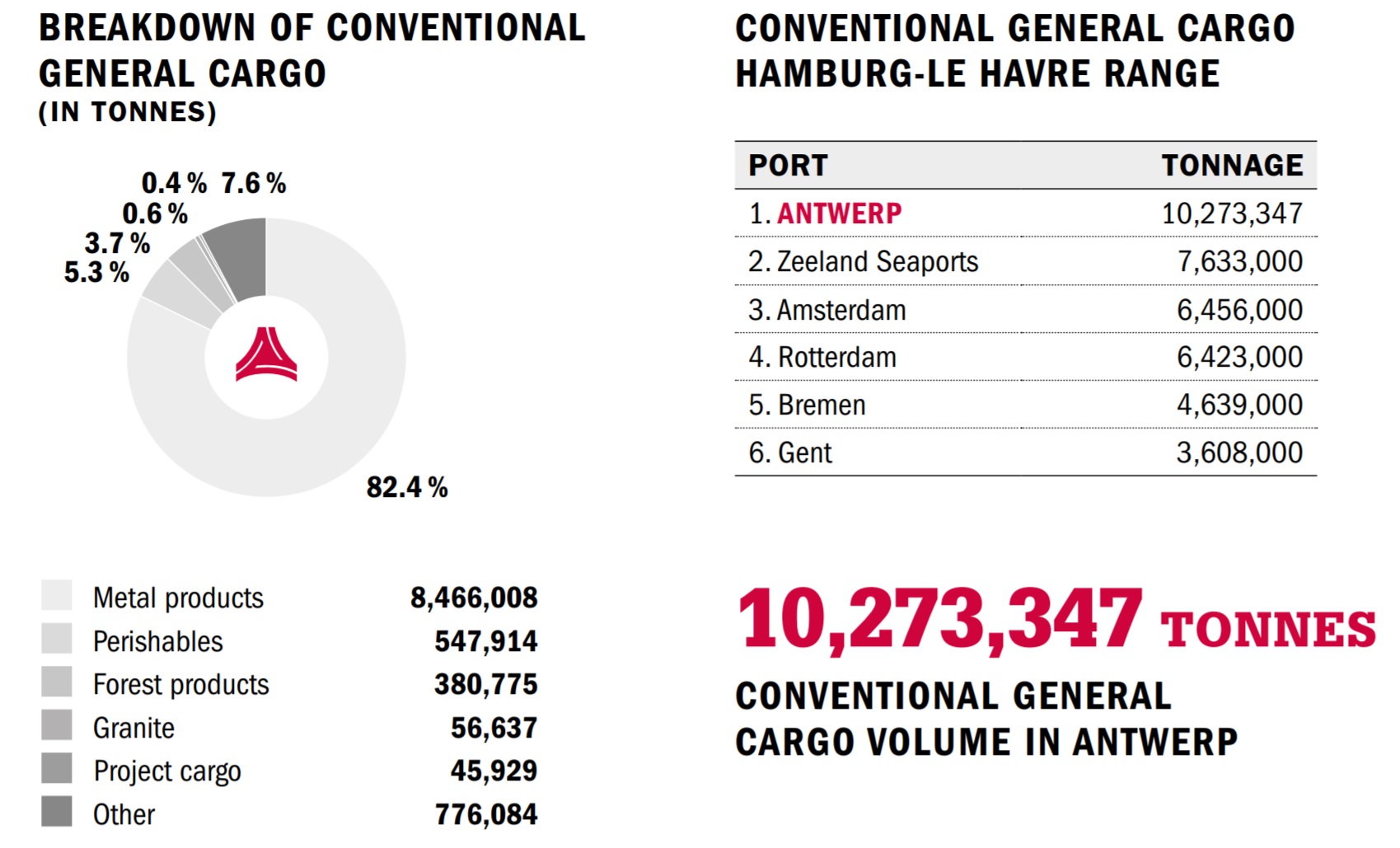

Antwerp’s breakbulk volume is largely made up of metal products, but the port also has a strong position in perishable cargoes and forest products. With 46,000 tonnes, the throughput of project cargo is relatively small accounting for only 0.4% of the total breakbulk volume.

ARTICLE CONTINUES BELOW IMAGES

Breakbulk handling in Port of Antwerp based on figures of 2017. (Source: Port of Antwerp)

Ro-ro

Antwerp’s ro-ro volumes, on the other hand, we’re up 3.2% in comparison with the first quarter of 2018 continuing a trend of growth. Last year, total ro-ro volume by 5.4% to 5.3 million tonnes. “Despite the decline in the number of rolling stock units, the number of tonnes went up thanks to the average weight per vehicle, especially in the utility vehicle category,” the port authority comments on its first-quarter results.

Total volume

Total maritime cargo turnover of Port of Antwerp fell by 3%, “bringing the situation back to normal following the record figures of the first quarter in 2018,” the port authority states. Adding that “as the quarter unfolded, the total maritime cargo turnover again showed an upward trend.”

The port expects that trend to continue in the coming months, “also thanks to extra MSC cargo between Antwerp and Northern Europe starting in April.” Container traffic in Antwerp continues to grow, with March 2019 as the strongest month ever in terms of containers, although the growth rate has decreased significantly. That is a result of the weakened economic outlook, Jacques Vandermeiren, CEO of the Port Authority, explains.

In the first three months of the year, 3,519 seagoing vessels called at Europe’s biggest breakbulk port.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.