Toepfer Transport: TMI stable despite poor spot MPP market

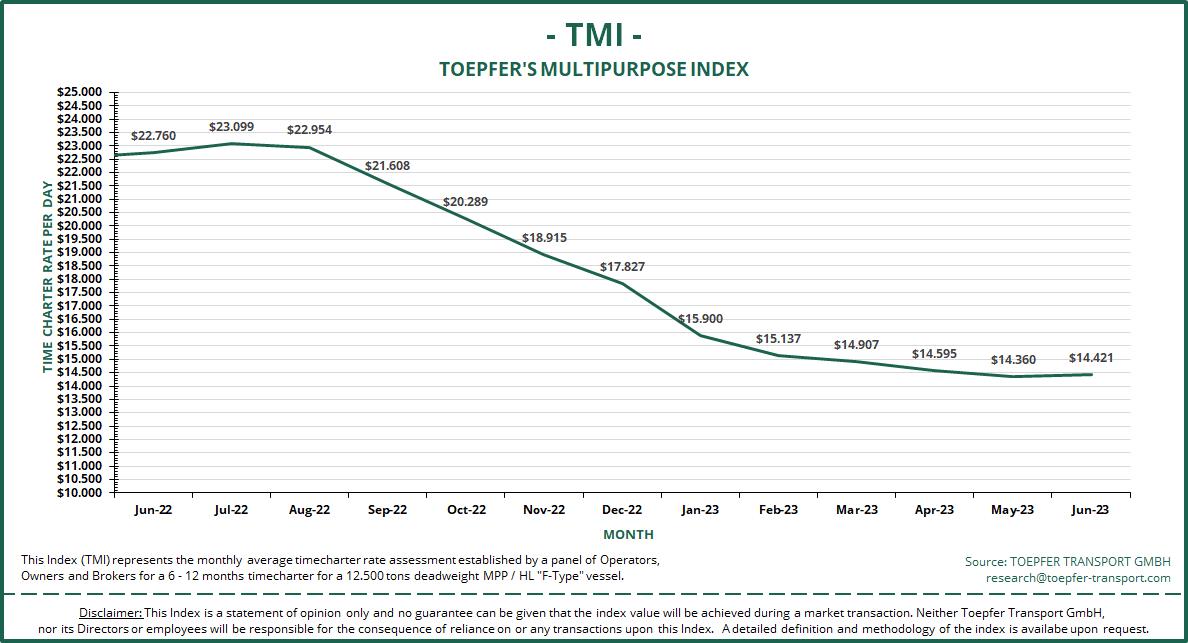

Time charter rates in the multipurpose (MPP) vessel sector, reflected in the Toepfer’s Multipurpose Index (TMI), remain stable despite a poor spot market. The Hamburg-based shipbroker adds that looking 6-12 months forward, the assessment includes some leap of faith.

In its latest report, Toepfer Transport noted that TMI for the month of June landed at $14,421 per day, just 0.46 per cent up on the previous month. Toepfer Transport expects the rates over the following six months to blip down some 0.29 per cent. For the following twelve months, the shipbroker foresees an index rise of just under 1 per cent, 0.96 per cent to be exact.

Compared to June 2022, when TMI stood at $22,760/day, June 2023 figures are 36.6 per cent down.

“Trades from Europe remain weak these days and with the upcoming summer holiday season any increase of activity will stay slow. On the demand side there is still limited activity from the minor bulk trades but increasing activity from the industrial projects and infrastructure markets,” Toepfer’s analysts say.

The Orderbook

In its latest monthly review Toepfer Transport noted that only 28 ships, or 2.92 per cent of the trading MPP fleet by deadweight capacity, are currently on order or under construction, most of which are assigned to special projects or contracts thus not available to the spot market for many years. Keeping up with the demands for a modern fleet with low CO2 emissions and capability to shoulder the transportation of wind turbines and other project cargo to drive energy transition remains a matter of concern.

Toepfer Transport also noted that the prices for 9,000 dwt, 12,500 dwt and 30,000 dwt newbuilds as well as the vessels in the secondhand market showed very little change.

To remind, newbuilding vessel prices were $19 million, $30 million and $49 million across the board in May, with the 30,000 dwt vessel prices ticking up to $50 million. In the second hand market prices stayed at $11.25 million for the 9,000 dwt vessels, while the prices for vessels in the 12,500 dwt and 30,000 dwt bracket slipped from $16.00 million and $20.5 million, respectively, to $15.5 million and $20 million, respectively.

Top market operators

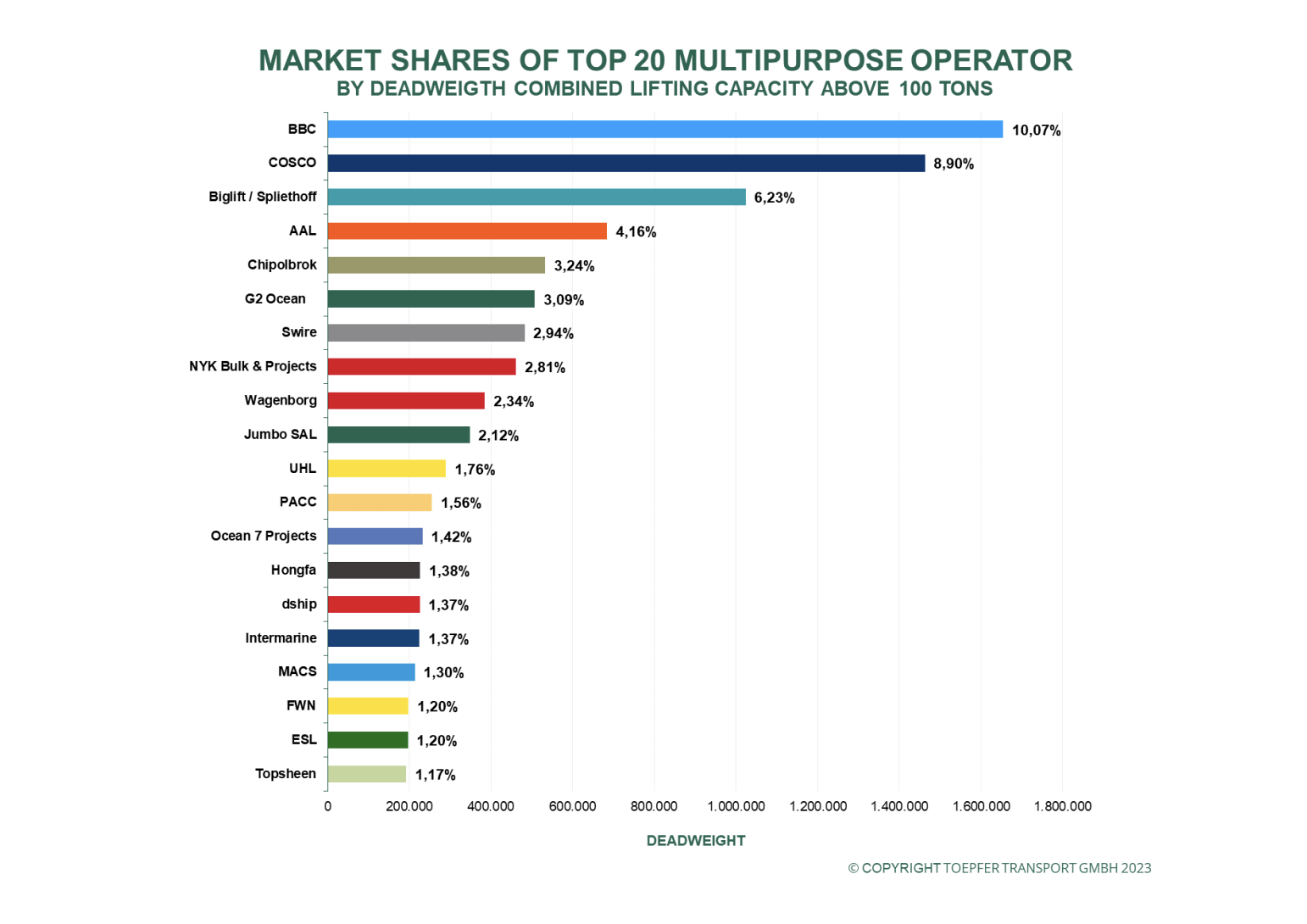

Toepfer Transport also released a list of the largest market operators, or top 20. According to the shipbroker, the market is quite fragmented with 14 of the Top 20 carriers having a market share below 3 pct, with many of them being regional players only.

By means of capacity BBC is still the largest player in the market but COSCO is continuing to catch up. The Top 5 operators employ 32.6 pct of the market capacity.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.